Adulting is hard and you best believe that because I'm not the only 20 - something year old who has said this - there are quite a few of us who have. So listen, I'm about to break it down for you so that maybe you have it a little easier than i have lately. In this post, I will breaking it down into the financial aspect of adulting. I'll have follow-up posts that speak about school, friendships and relationships.

SAVING YOUR MONEY 💸💸

I just had to dive right into it, didn't I? YES, I did. Saving is sooo important because you're keeping money away for future use. Say you need a deposit on your new car, or a deposit for your new apartment or you have an unexpected crisis in the next 6 months. That money can save your ass. How do you save? SIMPLE. Save 10% of your allowance/salary - if you're working. 10% isn't a lot especially if you have 90% of your salary left. If it is a bit too much, you might want to spend some time re-thinking how you spend your money.

I also take a look at my account at the end of the week - usually Fridays. After taking a look, I transfer what amount is necessary to make the last two digits of my balance zero. For example, If I have about R4 688.00 in my account on a Friday, I transfer R88.00 to my savings account. You'll see that the amount gradually increases. You can also do this bi-weekly to save even more cash.

You don't need to have goal or something you're saving towards so there's literally no reason why you should put saving on hold. Start today, start NOW. Don't worry about the amount, the whole point is that you earn interest so your money will gradually increase.

CREDIT & CREDIT SCORES 🚨🚨

Credit is bad, Credit is a trap. It seems appealing at first but trust me credit can cripple you. We've seen how debt has put our parents in so much distress. "If you cant afford to buy something 5/4 x over then don't buy it at all" - Euphonik tweeted this and I can't help but agree with him? I guess it somehow keeps you in check so that you don't buy things you can't afford - like a car.

The tricky thing is though, you need a credit score before you can make all the "important" purchases in your life. Like a car or a house - unless you're going to settle the amount cash? Anyway to get a credit score, you need credit.

SIDE NOTE: Please don't get credit for food it's really not necessary. ☝

You can open a clothing account and maybe buy a pair of jeans and gradually pay it off. What and how much you purchase on credit is what you wouldn't mind paying monthly for. So, if you wouldn't mind forking out R200 for 6 to 12 Months, then by all means purchase but, if you can't fork out R450 for a period of 6 to 12 months then don't buy it.

Speaking from experience, you feel so great when you buy, buy, buy on credit but when it's time for the monthly payments you start to regret those purchases, like was this denim jacket really worth it?

Credit is spending money you don't have and repaying it with interest when you do. It sucks that you need a good credit score but it's just how banks determine if they should lend you money or not. Also, the better your credit score (meaning if you are on-time with your monthly payments) the better your interest rates. Simple. Now I don't know if it's interest on credit (Pretty sure its this one) or interest that actually goes into your pocket.

BUDGETS - THEY ACTUALLY WORK 🤑🤑

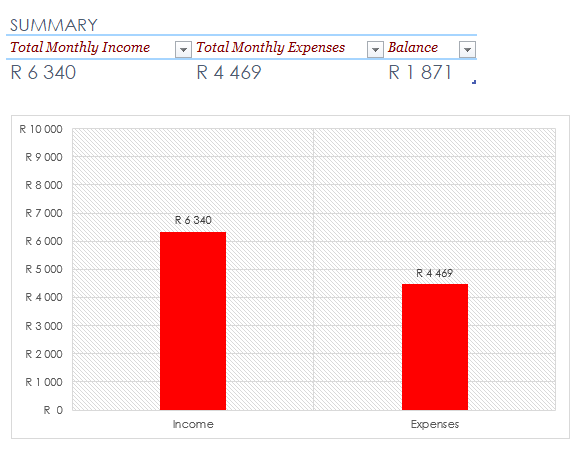

Budgets are Legit. I can assure you that I was once like you, doubtful and weary of budgets until I actually drew up my own - well more like downloaded a template on excel. It helps me see how much I'm going to spend within the month (Expenses) and how much have left over (Income - Expenses). Its also advisable that you don't overspend, leave a bit of money over for next month so at least you boost yourself up a bit.

Two words, Budget templates. When it came to creating a budget I used to just write down my expenses in pen, on a piece of scrap paper that I found which didn't prove to be effective. So I searched for templates on excel and downloaded a simple budget and savings template.

All I do is input any extra income that will come through in that particular month, then add any expected expenses for the month (Names + amounts) and click enter - excel does EVERYTHING FOR YOU.

|

| Example of what your excel budget spread sheet could like - Hopefully you don''t have this many expenses 😉 |

I have found that the budgets aren't complicated so if you're looking for more information on your budget then I suggest you check if your bank doesn't offer such apps. I know FNB recently launched a money app that tells you if you're spending more money than you're earning.

BLACK TAX 👀

The notorious black tax makes it way back onto my blog again. You're probably wondering why on earth black tax is part of this finance talk. Well, black tax is an expense and has everything to do with finance. Black parents expect you to do EVERYTHING when you land your first proper job - I know, I'm experiencing it. What they seem to forget is that they need to give you space to find your feet financially, experience the lessons that come with bad financial decisions and allow you to use your money to invest in yourself.

Granted, if you can help around the house then do so without being asked.Chip in on the electricity and if your dad gives you a ride to work pitch in as well. Even if you use your allowance, it's the thought that counts. Remember, you cannot pour from an empty cup so only if you're able to, not if you really can't. If your parents complain about you not pitching in financially, sit them down and let them know about your finances and why you can't - you're an adult and this shows responsibility on your part. It's also helpful to remember, you're living rent-free in your parents house so don't be stingy with helping out. That reason is not a "Get out of jail free card" that allows you the financial freedom to not buy your own toiletries, you're a grown ass human.

That about sums up what I've got to say when it comes to finance. If you perhaps have some finance tips of your own you can drop them in the comment's section below. Other comments are welcome as well.

Granted, if you can help around the house then do so without being asked.Chip in on the electricity and if your dad gives you a ride to work pitch in as well. Even if you use your allowance, it's the thought that counts. Remember, you cannot pour from an empty cup so only if you're able to, not if you really can't. If your parents complain about you not pitching in financially, sit them down and let them know about your finances and why you can't - you're an adult and this shows responsibility on your part. It's also helpful to remember, you're living rent-free in your parents house so don't be stingy with helping out. That reason is not a "Get out of jail free card" that allows you the financial freedom to not buy your own toiletries, you're a grown ass human.

That about sums up what I've got to say when it comes to finance. If you perhaps have some finance tips of your own you can drop them in the comment's section below. Other comments are welcome as well.

No comments

Feel Free To Drop Your Comments! Your Opinion Matters!